The Options Greeks - AKA The Greeks help us to understand Options pricing and how the price of a stock can affect the value of your contracts in different ways.

Practicing daily rituals is one of the best methods to achieve great focus. As you know, some of these trades demand a higher level of focus and attention than others. What you do every day defines who you are.

Volume, Price Action, and Supply & Demand are all you need to identify high probability setups.

Many traders tend to lose big instead of winning small because we get caught up in the emotions associated with the trades. We stare at the P/L percent, and watch the dollar amounts very carefully. Though we entered the trade with a plan, now that we are in, we are considering making the plan a bit more flexible to suit our new needs.

#TheStrat is a simplified trading system that helps you to clearly identify entry and exit points, easily find price targets, and take action with clear signals. All levels of traders can benefit from using this system.

Each and every Sunday we have a broad market overview, along with an analysis of some of the best technical setups ready to go for Monday morning. Come for the analysis, stay for the fun!

Don’t shoot the messenger. The message is much needed. Also, this is coming from a place of compassion and empathy. Pack it up, b.

Contrary to what popular songs of today might say, where they encourage you to look back at it, NEVER look back at trades you sold out of. Well, at least until a little later where emotions simmer down, and it will not mentally mess you up.

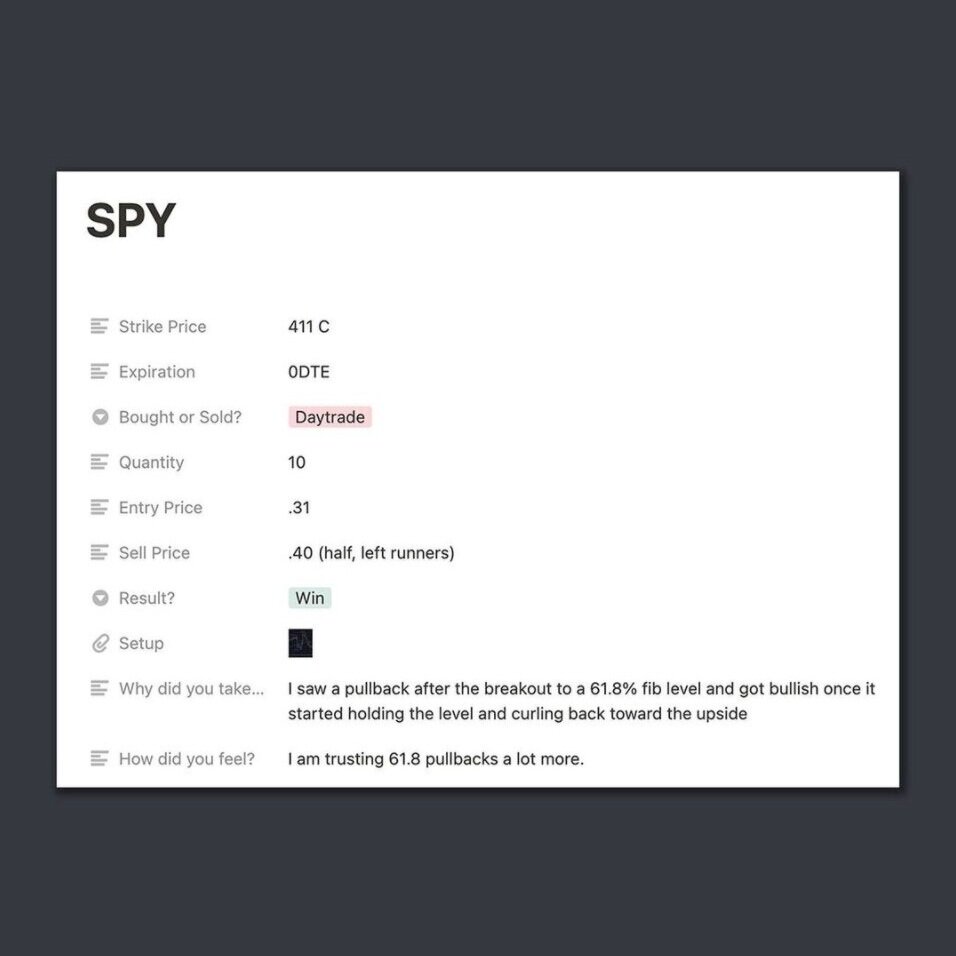

Journaling your trades is probably the LEAST sexy aspect of trading. Some probably actually treat it like a rubber and forego it entirely when they enter their position. They raw dog the trade, slip up, then wonder what happened and how they ended up here. Forgive all the imagery, but I want to drive the point home: You should be journaling your trades.